Hyperswap is Revolutionizing Decentralized Trading on HyperEVM

The decentralized finance landscape continues to evolve at an unprecedented pace, and Hyperswap stands at the forefront of this transformation. As a native decentralized exchange built specifically for the HyperEVM ecosystem, Hyperswap represents a new generation of trading platforms designed to deliver exceptional performance, minimal fees, and seamless user experiences. In this comprehensive guide, we will explore everything you need to know about Hyperswap, from its core functionality to its innovative features that set it apart from traditional decentralized exchanges.

Understanding the Foundation of Hyperswap

Hyperswap emerged as a response to the growing demand for efficient, low-cost trading solutions within the rapidly expanding HyperEVM network. Unlike conventional decentralized exchanges that often suffer from high gas fees and slow transaction times, Hyperswap leverages the unique capabilities of the Hyperliquid ecosystem to provide traders with an optimized experience. The platform was designed from the ground up to take full advantage of the underlying blockchain infrastructure, ensuring that every swap, liquidity provision, and transaction occurs with maximum efficiency.

The development team behind Hyperswap recognized that existing DEX solutions often failed to meet the needs of modern traders. By building Hyperswap specifically for HyperEVM, they created a platform that inherently understands and utilizes the network's strengths. This native integration allows Hyperswap to offer features and performance metrics that would be impossible to achieve on other blockchain networks.

Core Technology and Architecture

At its heart, Hyperswap utilizes an automated market maker model that has been refined and optimized for the HyperEVM environment. This AMM protocol enables users to trade tokens directly from their wallets without the need for traditional order books or intermediaries. The smart contracts powering Hyperswap have been carefully audited and designed to ensure security while maintaining the flexibility needed for advanced trading strategies.

Hyperswap implements a sophisticated liquidity pool system that incentivizes users to provide liquidity in exchange for trading fees and additional rewards. This model creates a self-sustaining ecosystem where liquidity providers benefit from their contributions while traders enjoy deep liquidity and minimal slippage on their transactions.

Key Features That Define Hyperswap

The feature set of Hyperswap extends far beyond basic token swapping functionality. The platform has been engineered to serve as a comprehensive DeFi hub within the HyperEVM ecosystem, offering tools and capabilities that cater to both novice users and experienced traders alike.

Lightning-Fast Transaction Processing

One of the most significant advantages of using Hyperswap is the remarkable transaction speed enabled by the HyperEVM network. While users of other decentralized exchanges often wait minutes for their trades to confirm, Hyperswap processes transactions in mere seconds. This speed advantage becomes particularly crucial during periods of high market volatility when every second can mean the difference between profit and loss.

Hyperswap achieves these impressive speeds without sacrificing decentralization or security. The platform maintains the trustless nature that defines decentralized finance while delivering performance that rivals centralized exchanges. This combination of speed and decentralization represents one of the core value propositions that Hyperswap brings to the market.

Minimal Trading Fees

Gas fees have long been a pain point for users of decentralized exchanges, particularly on networks like Ethereum where transaction costs can sometimes exceed the value of smaller trades. Hyperswap addresses this concern by operating on HyperEVM, where gas costs are substantially lower than on legacy blockchain networks.

The fee structure implemented by Hyperswap has been carefully calibrated to balance the needs of traders, liquidity providers, and the long-term sustainability of the platform. Users can execute trades on Hyperswap knowing that excessive fees will not erode their profits, making the platform accessible to traders of all sizes.

Liquidity Provision on Hyperswap

Becoming a liquidity provider on Hyperswap offers users the opportunity to earn passive income while contributing to the health of the ecosystem. The process of providing liquidity has been streamlined to ensure that even users new to DeFi can participate without confusion or unnecessary complexity.

How Liquidity Pools Work

Hyperswap liquidity pools operate on the constant product market maker model, where the product of the reserves of two tokens in a pool remains constant during trades. When users provide liquidity to Hyperswap, they deposit equal values of two tokens into a pool and receive LP tokens representing their share of that pool.

These LP tokens serve as proof of deposit and can be redeemed at any time for the underlying assets plus accumulated fees. The transparent nature of Hyperswap means that liquidity providers can always verify their positions and track their earnings in real-time through the platform interface.

Earning Rewards as a Liquidity Provider

Liquidity providers on Hyperswap earn a portion of the trading fees generated by their pools. Every time a trader executes a swap through a pool, a small fee is collected and distributed proportionally among all liquidity providers in that pool. This creates a compelling incentive structure that encourages users to provide liquidity and helps ensure deep markets for traders.

Beyond standard trading fees, Hyperswap may offer additional incentive programs designed to bootstrap liquidity for new trading pairs or reward long-term liquidity providers. These programs demonstrate the commitment of Hyperswap to building a thriving ecosystem where all participants can benefit.

The User Experience on Hyperswap

Hyperswap places significant emphasis on user experience, recognizing that even the most powerful DeFi platform is only valuable if users can easily access its features. The interface of Hyperswap has been designed with clarity and simplicity in mind, ensuring that users can accomplish their goals without unnecessary friction.

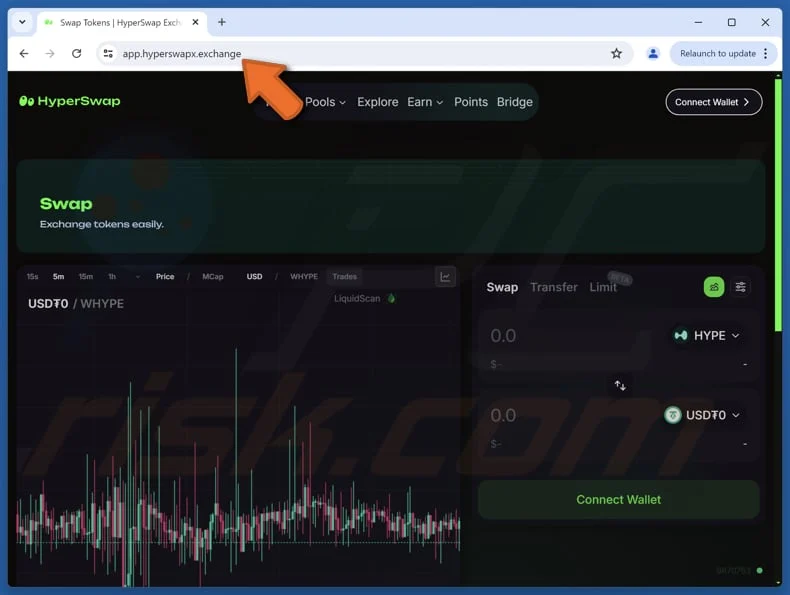

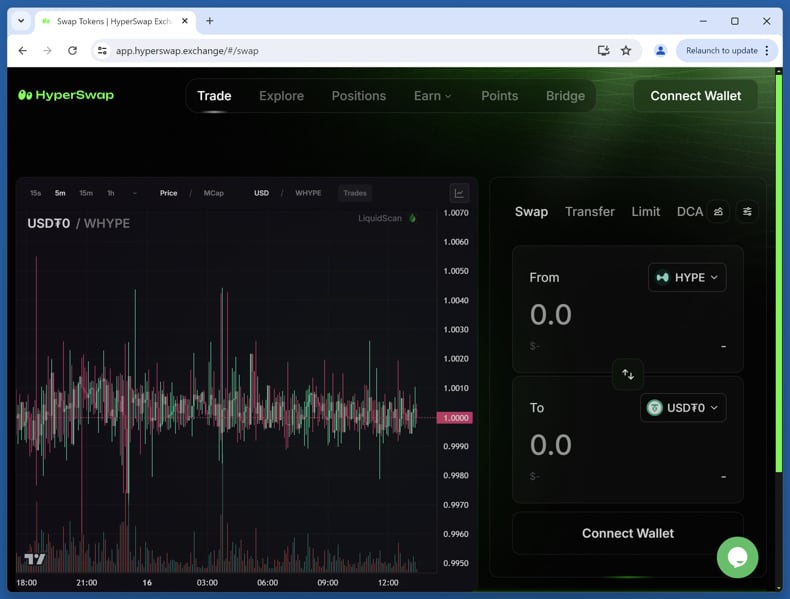

Intuitive Trading Interface

The trading interface of Hyperswap presents users with all the information they need to make informed decisions while avoiding the clutter that plagues many competing platforms. Users can quickly select their input and output tokens, view current exchange rates, and estimate the output of their trades before execution.

Hyperswap also provides advanced options for experienced traders who want more control over their transactions. Settings for slippage tolerance and transaction deadlines allow users to customize their trading experience according to their preferences and risk tolerance.

Wallet Integration and Security

Connecting to Hyperswap is straightforward thanks to support for popular wallet solutions compatible with the HyperEVM network. Users maintain complete custody of their assets throughout the trading process, with tokens only leaving their wallets when trades are executed. This non-custodial approach ensures that Hyperswap users never have to trust a centralized entity with their funds.

The security architecture of Hyperswap has been designed to protect users from common attack vectors while maintaining the openness and transparency expected of decentralized applications. Smart contracts undergo rigorous testing and auditing to identify and address potential vulnerabilities before they can be exploited.

Hyperswap Within the Broader Ecosystem

While Hyperswap functions as a powerful standalone platform, its true potential becomes apparent when considered within the context of the broader HyperEVM ecosystem. As the native DEX for this network, Hyperswap serves as critical infrastructure that enables other applications and protocols to flourish.

Enabling DeFi Innovation

The presence of Hyperswap within the HyperEVM ecosystem provides other developers with reliable liquidity infrastructure they can build upon. Projects launching tokens on HyperEVM can establish trading pairs on Hyperswap, giving their communities immediate access to liquid markets. This symbiotic relationship between Hyperswap and the broader ecosystem creates a virtuous cycle of growth and innovation.

Hyperswap also serves as a price discovery mechanism for assets within the ecosystem. Other protocols can reference Hyperswap prices for their own operations, whether for lending platforms determining collateral values or derivative products tracking underlying asset prices.

Community and Governance

The future direction of Hyperswap will increasingly be shaped by its community of users and stakeholders. Decentralized governance mechanisms allow token holders to participate in decisions about protocol upgrades, fee structures, and other important parameters. This community-driven approach ensures that Hyperswap evolves in ways that serve the interests of its users rather than any centralized authority.

Engagement with the Hyperswap community extends beyond formal governance processes. Active discussion channels allow users to share feedback, suggest improvements, and connect with other members of the ecosystem. This vibrant community represents one of the most valuable assets of the Hyperswap platform.

Getting Started with Hyperswap

For users ready to experience the benefits of Hyperswap firsthand, getting started is a straightforward process. The platform welcomes users of all experience levels and provides the resources needed to begin trading or providing liquidity with confidence.

Setting Up Your Wallet

Before using Hyperswap, users need a compatible wallet configured for the HyperEVM network. Popular options include browser extension wallets that support custom network configurations. Once your wallet is set up and funded with native tokens for gas fees, you can connect to Hyperswap and begin exploring its features.

Making Your First Trade

Executing your first trade on Hyperswap involves selecting the tokens you wish to swap, entering the amount, reviewing the transaction details, and confirming through your wallet. The entire process takes just seconds, and your new tokens will appear in your wallet almost immediately after confirmation.

Hyperswap provides clear feedback throughout the trading process, ensuring that users understand exactly what will happen before they confirm any transaction. This transparency builds trust and helps users avoid costly mistakes.

The Future of Hyperswap

As the HyperEVM ecosystem continues to grow and mature, Hyperswap is positioned to evolve alongside it. The development roadmap includes plans for new features, improved performance, and expanded capabilities that will further cement the position of Hyperswap as the premier trading venue within the ecosystem.

Upcoming developments for Hyperswap may include advanced trading features, improved liquidity incentive mechanisms, and deeper integrations with other protocols in the ecosystem. The team remains committed to continuous improvement and responsive to community feedback in prioritizing development efforts.

Conclusion

Hyperswap represents a significant advancement in decentralized exchange technology, combining the trustless nature of DeFi with the performance characteristics that modern traders demand. By building natively on HyperEVM, Hyperswap delivers an experience that sets new standards for what decentralized exchanges can achieve. Whether you are a trader seeking efficient markets, a liquidity provider looking for yield opportunities, or a developer building the next generation of DeFi applications, Hyperswap provides the infrastructure and tools you need to succeed. As the ecosystem continues to expand, Hyperswap will remain at its center, facilitating the exchange of value and enabling innovation across the entire network.

Search on Youtube!